Long Giang Land General Meeting of shareholders: To promote relationship with investors

At the 2019 Annual General Meeting of Shareholders (AGM) held on the morning of April 27, Board of Management of Long Giang Land said, Board of Management is aware that only making efforts domestically is not enough, it is necessary to promote the relationship with investors.

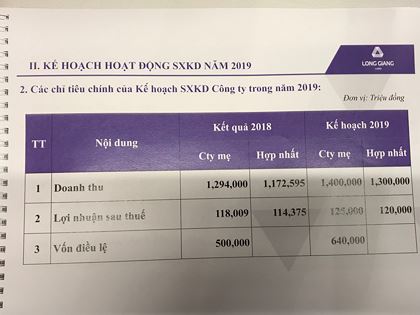

Regarding the Company’s production and business results in 2018, Mr. Le Ha Giang, Chairman of the Board of Management of Long Giang Land said that the net revenue of the parent company reached 1,294 billion Vietnamese dongs, 8% higher than the plan, profit after tax of the parent company is 157 billion Vietnamese dongs, 5% higher than the plan, increase 26% higher than the same period and profit after tax is 118 billion Vietnamese dongs.

“The 2018 revenue structure of Long Giang Land clearly shows the business strategy focusing on real estate sector with the contributing percentage to consolidated revenue up to 93%,” Mr. Giang said.

Mr. Giang also said that the 2018 production and business results were impressive thanks to the company’s good quality products, highly appreciated by customers and the market. The company has selected and cooperated with the qualified sales consultant unit. The business performance is be effectively implemented.

Rivera Park Hanoi project was handed over on time as committed to customers onJuly 01, 2018. The costs of enterprises are well controlled based on the experience of Long Giang Land in the production.

“By completing and handing over to put into use Rivera Park Hanoi project in 2018, Long Giang Land has officially affirmed its position in the real estate market as a professional estate developer. Long Giang Land has also became member of a small group of real estate companies owning a series of projects nationwide with 2 completed projects in Hanoi and Ho Chi Minh City, ” stressed Mr. Giang,

In order to prepare for the next development phase, the company has increased its charter capital from VND 346 billion to VND 500 billion with equity of over VND 770 billion. In addition, the company has also promoted M&A activities with the acquisition and increase of ownership in companies holding a series of real estate projects in prime locations.

The company has accelerated progress and completed investment legal procedures to prepare for the commencement of at least two new projects in 2019 in Hanoi and Can Tho (Rivera Park Long Bien and Rivera Park Cai Khe projects).

For M&A activities, Long Giang Land has acquired 51% of shares from Viet Hung Garment and Embroidery Real Estate Investment Joint Stock Company; Increased ownership in Minh Phat JSC from 51% to 65%; Increased the ownership percentage in Nghia Do Commercial and Service JSC from 25.89% to 52.46%.

Replying shareholders’ question regarding why the company’s business is well but the stock prices is still low, shared Mr. Giang, when LGL was listed, it may be thank to luck and may be listed on the floor at the right time so the stock price increased sharply but then occurring the crisis, the price went down, and for the last three years, the leader of Long Giang Land always got this question at the General Meeting of Shareholders.

“Investors in the stock market have their own reasons when buying stocks,” said Mr. Giang.

Answer questions of shareholdersMr. Giang also illustrated the company’s interesting story of when having good product, Hanoi River Park which is the product among the best group at present but the actual business result does not reflect the product quality when the price is reasonable, quality is good but only sold 50%. Therefore, when the Board of Management hired a professional sales unit, 45% of the remaining apartments of the project were sold off in 3 months.

“The market is in such way, good and reasonable price, but the sales speed is sometimes not equal to and I think the stock market is similar,” said Mr. Giang.

Receiving lots of opinions that despite potential shares, if there has no change, the liquidity and price of LGL share are only at that level. Being aware of the importance of relationship with investors, only internal effort is not enough, it is necessary to strengthen the relationship with investors.

“The Board of management chose the consulting unit, SHS, to consult about relationship with the owner and the first change is that Long Giang Land must have an annual report from SHS’s consultation. LGL’s image began to change dramatically. However, the pathway to improve liquidity and stock prices is still long, it is difficult to have big change,” Giang said.

In response to questions of shareholders about foreign investors, Mr. Giang said that the company receives interest from foreign investors is normal but the promotion is not too close. When the information is available, the shareholders will be informed about this.

Regarding capital raising, Mr. Giang admitted, the story of raising capital of the Company in the past, at present and in the future is quite modest and the company has a tradition of carrying business from the zero.

Mr. Giang shared that at the time Long Giang Land started Rivera Park Ho Chi Minh City project, it had only 1 billion VND but the Company used other capital sources such as capital from business cooperation with partners, funds from bank although the State bank of Vietnam has started to tighten, and especially, when the project was clear, the company would issue corporate bonds. This is a very good channel for raising capital.

“The enterprise’s prestige of enterprises in keeping their commitments to organizations, partners and investors, I believe that the raising of capital will be smooth,” said Mr. Giang.

The company’s 2019 business plan is as follows:

It is said that based on the of production and business operation results in 2018 and the plan approved by the General Meeting of Shareholders in 2018, the Board of Management of Long Giang Land has approved 2018 dividend payment schedule in cash at the rate of 12%.

Tiếng Việt

Tiếng Việt